UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.__)

Filed by the Registrant ý

Filed by a Party other than the ☐ Registrant

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| OVERSEAS SHIPHOLDING GROUP, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| ☐ | Fee paid previously with preliminary materials. | |

Notice of Annual Meeting of Stockholders

DATE & TIME

Wednesday, June 1, 2022 at 9:30 am, Eastern Time.

LOCATION

Stockholders may participate in the completely virtual annual meeting by dialing (844) 200-6205 for US/Canada callers and (929) 526-1599 for international callers and entering Access Code 885895.

RECORD DATE

Stockholders of record at the close of business on April 6, 2022, are the only stockholders entitled to notice of, and to vote at, the annual meeting.

MATERIALS

These proxy materials and our annual report were first sent or made available to stockholders on or about April 19, 2022.

ITEMS OF BUSINESS

| (1) | ||

| (2) |

| Statement; | ||

| (3) | to ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for 2022; | |

| (4) | To approve an amendment to the Overseas Shipholding Group, Inc. 2019 Incentive Compensation Plan for |

| Management to increase the number of shares of Common Stock available for issuance by five (5) million shares; and | |

| (5) |

We are taking advantage ofutilizing the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders over the Internet. We believe these rules allow us to provide stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting. If you received a printed copy of the materials, we have enclosed a copy of the Company'sCompany’s Annual Report on Form 10-K for the year ended December 31, 20182021 (the “2021 Form 10-K”) with this Notice and the accompanying Proxy Statement.

It is very important that you are represented at the Annual Meeting and that your shares are voted. We urge you to vote as soon as possible by telephone, over the Internet, or by marking, signing and returning your proxy or voting instruction card, even if you plan to attend the Meeting in person. If you attend the Meeting and wish to vote in person, you may withdraw your proxy and vote in person.card. Your prompt consideration is greatly appreciated.

| /s/ SUSAN ALLAN | |

| Vice President, General Counsel and Corporate Secretary | |

| Tampa, Florida | |

| April |

PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

| REMOTE PARTICIPATION IN ANNUAL MEETING | 1 |

| PROXY SUMMARY | 1 |

| 6 | |

| 11 | |

| 15 | |

| 16 | |

| 17 | |

| 28 | |

| 29 | |

| 31 | |

| 33 | |

| 34 | |

| 35 | |

| 36 | |

| OWNERSHIP OF CLASS A COMMON STOCK BY DIRECTORS, EXECUTIVE OFFICERS AND CERTAIN OTHER BENEFICIAL OWNERS | 38 |

| 39 | |

| 40 | |

| 41 | |

| 42 |

| i |

OVERSEAS SHIPHOLDING GROUP, INC.

302 Knights Run Avenue, Suite 1200

Tampa, FL 33602

PROXY STATEMENT

_______________________________________________REMOTE PARTICIPATION IN ANNUAL MEETING

To participate in the Annual Meeting, dial (844) 200-6205 for US/Canada callers and (929) 526-1599 for international callers and enter Access Code 885895. Please dial in ten minutes prior to the start of the call. Stockholders and other interested parties can listen to a live webcast of the Meeting from the Investor Relations section of OSG’s website at www.osg.com.

We urge you to vote as soon as possible by telephone or over the Internet. If you wish to vote on the date of the Annual Meeting or to change your vote, you may do so by sending an email to Investor-Relations@osg.com and attaching either your proxy card or your voting instruction form and the legal proxy provided by your bank, broker or other nominee. This information is necessary in order for your vote to be counted. Your email must be submitted by 9:35 a.m. (ET) on Wednesday, June 1, 2022.

An audio replay of the Annual Meeting of Stockholder will be available starting at 11:00 a.m. (ET) on Wednesday, June 1, 2022 until June 8, 2022 by dialing (866) 813-9403 for US/Canada callers and (929) 458-6194 for international callers and entering Access Code 849003.

This summary provides an overview of information contained in the Proxy Statement. This summaryIt is not intended to provide all of the information withinin the Proxy Statement, which we recommend that you should read and consider prior to voting. ForWe also invite you to review our 2021 Form 10-K and our Sustainability Report for the year ended December 31, 2021 (the “2021 Sustainability Report”) to obtain a more comprehensive discussion of Overseas Shipholding Group, Inc.'s (the "Company" or "OSG") The Sustainability Report is not incorporated by reference in this Proxy Statement.

OSG qualifies as a Smaller Reporting Company under SEC rules. As a Smaller Reporting Company, we are permitted to omit certain disclosures from this Proxy Statement that are required for larger companies, including our performance in 2018, please also reviewsome additional disclosures relating to executive compensation. However, we recognize the Company's Annual Report on Form 10-K for the year ended December 31, 2018 (the "2018 Form 10-K")importance of transparency and, accordingly, have chosen to provide certain compensation-related disclosures that we historically provided but are no longer required to provide.

| 1 |

Voting Matters "Roadmap"

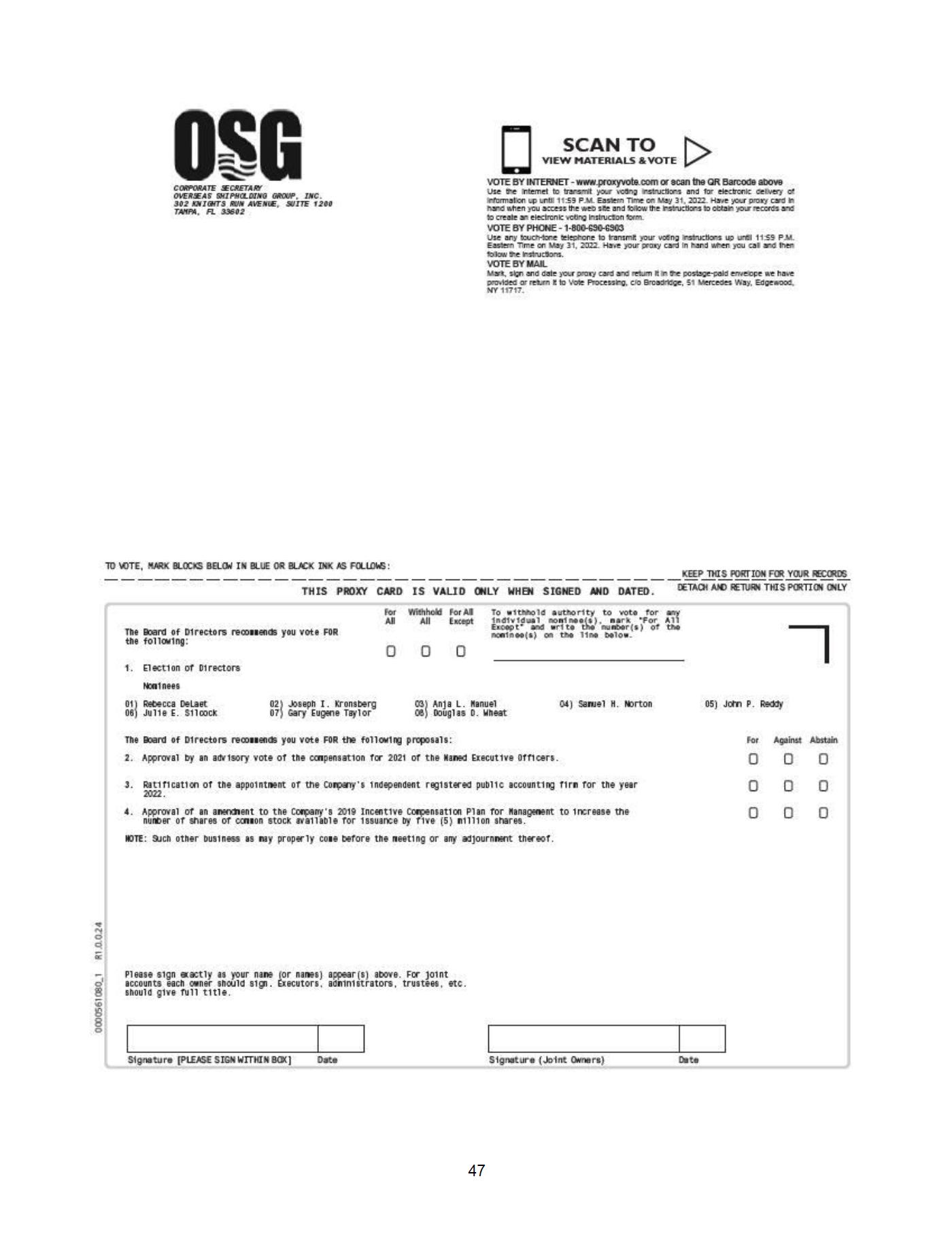

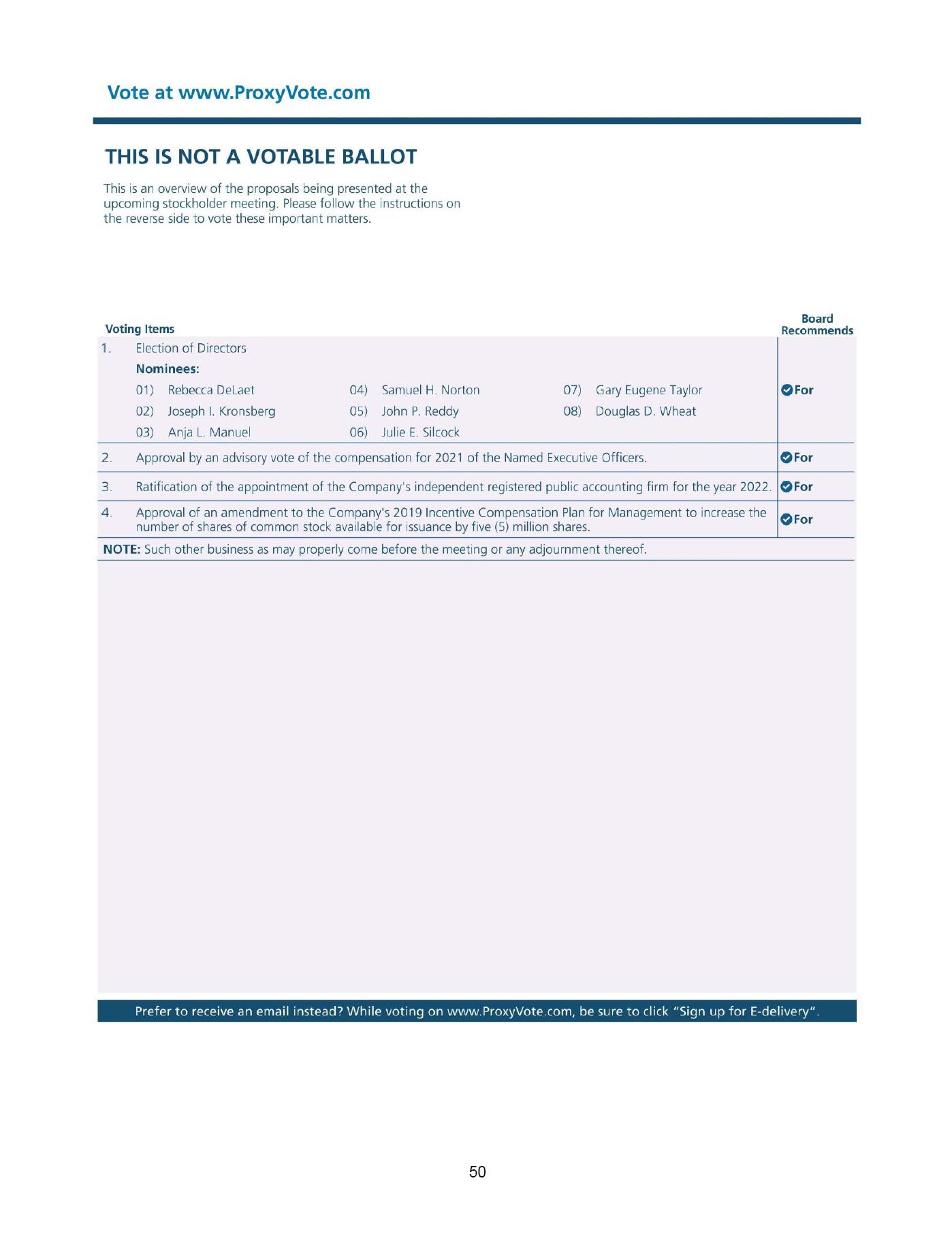

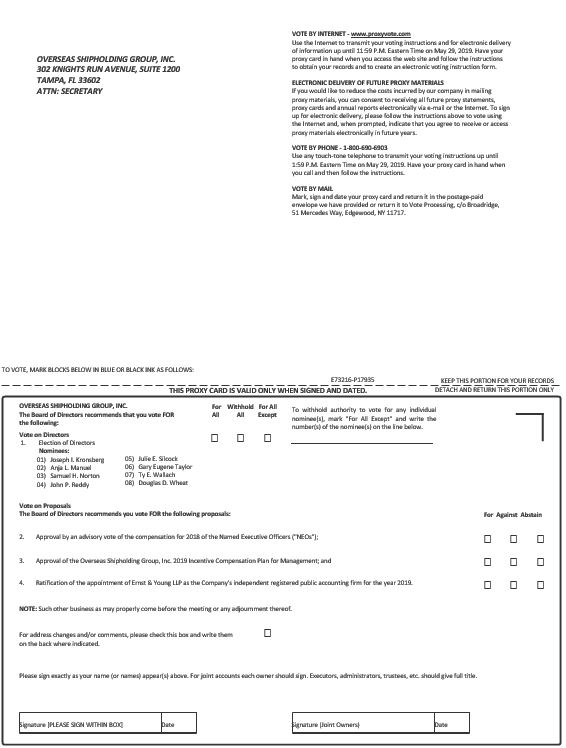

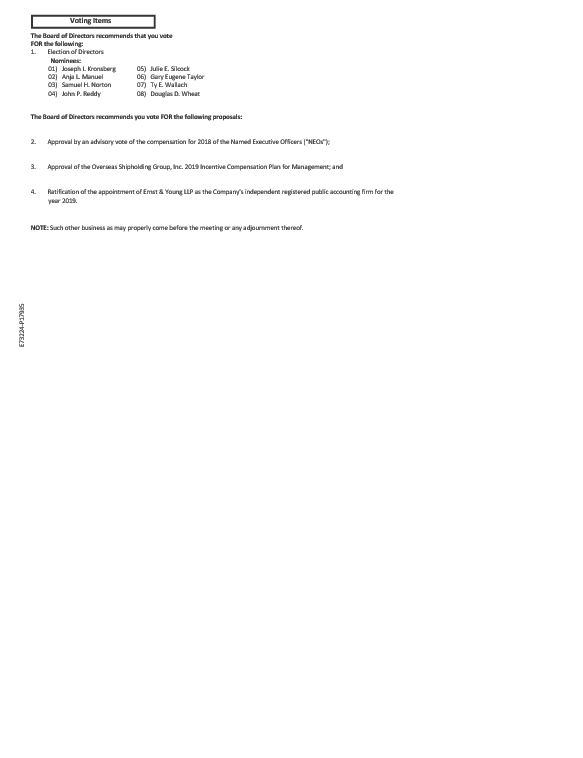

Our stockholders are being asked to vote on the following matters at our 20192022 Annual Meeting:

| PROPOSALS | ||

The Board and the Corporate Governance and Risk Assessment Committee believe that each of the | FOR Each Director Nominee | |

| The Human Resources and Compensation Committee believes that the compensation paid to our Named Executive Officers and our overall pay practices are proper and supportable, and asks our stockholders to cast a favorable non-binding advisory vote on the compensation of the Named Executive Officers | FOR | |

The Audit Committee believes it to be in the best interest of the Company and its stockholders to retain the services of Grant Thornton LLP as the independent auditors of the Company for the fiscal year ending December 31, 2022 and asks stockholders to ratify this appointment. | FOR | |

| PROPOSAL 4. To approve an amendment to the Overseas Shipholding Group, Inc. 2019 Incentive Compensation Plan | ||

The Board and the Human Resources and Compensation Committee believe it to be in the best interests of the Company | ||

| FOR |

| 2 |

Company Overview

OSG is a leading provider of energy transportation services, delivering crude oil and petroleum products to major oil companies and refiners. OurOSG’s 24 vessel fleet, includes tankers and Articulated Tug Bares, or ATBs, of which 19 nineteen operate under the Jones Act23 are U.S. flag vessels, consists of three crude oil tankers doing business in Alaska, two conventional articulated tug-barge units (“ATBs”), two lightering ATBs, three shuttle tankers, ten medium range tankers, one tanker in cold layup, and two operate internationally andnon-Jones Act tankers that participate in the U.S. Maritime Security Program. OSG also owns and operates one Marshall Islands flagged MR tanker, which trades internationally. We provide safe, efficient, and reliable transportation to our customers and strive to ensure the highest standards of safety and environmental compliance throughout our organization.

Board Highlights

| BOARD OF DIRECTORS | OSG Committee Membership | |||||||||||

| Name | Age | Tenure years(1) | Primary Occupation | A | C | G | ||||||

| Douglas Wheat (Non-Executive Chairman) | 71 | 8 | Managing partner of Wheat Investments | |||||||||

| Rebecca K. DeLaet | 54 | 2 | Former CFO of O.G. Energy | X | ||||||||

| Joseph I. Kronsberg | 39 | 7 | Former Partner at Cyrus Capital Partners, L.P. | |||||||||

| Anja L. Manuel | 47 | 5 | Founding partner at Rice, Hadley, Gates & Manuel LLC | X | X* | |||||||

| Samuel H. Norton | 63 | 8 | CEO and President of OSG | |||||||||

| John P. Reddy | 69 | 4 | Former CFO of Spectra Energy and private investor | X* | X | |||||||

| Julie E. Silcock | 66 | 4 | Senior Advisor for CDX Advisors | X | X* | |||||||

| Gary Eugene Taylor | 68 | 8 | Former member of U.S. Congress | X | X | |||||||

* Indicates Chair of the Company well by capitalizing on an improving rate environment, reducing debt, and taking steps to gain cost efficiencies. In doing so, we are better positioned to benefit from our business model and to generate a positive long-term investment for our stockholders.

| BOARD OF DIRECTORS | OSG Committee Membership1 | ||||||

| Name | Age | Director Since | Primary Occupation | A | C | G | |

Douglas Wheat (Non-Executive Chairman) | 68 | 2014 | Managing partner of Wheat Investments | ||||

| Joseph I. Kronsberg | 36 | 2015 | Partner at Cyrus Capital Partners, L.P. | ||||

| Anja L. Manuel | 44 | 2017 | Founding partner at RiceHadleyGates LLC | X | X2 | ||

| Samuel H. Norton | 60 | 2014 | CEO and President of OSG | ||||

| John P. Reddy | 66 | 2018 | Business consultant and private investor | X2 | X | ||

| Julie E. Silcock | 63 | 2018 | Co-head of Southwest Investment Banking franchise at Houlihan Lokey | X | X2 | ||

| Gary Eugene Taylor | 65 | 2014 | Former member of U.S. Congress | X | X | ||

| Ty Wallach | 47 | 2015 | Former partner at Paulson & Co. Inc. | X | |||

A

C

G

(1) The average tenure of the Committee

Governance Highlights

OSG is committed to cultivating and sustainingmaintaining leading corporate governance practices. We believe that sound governance policies encourage accountability of the Board and management, improve our standing within our industry, and promote the long-term interests of our stockholders.

Board Leadership Structure & Independence

| ● | We separate the roles of the CEO and Chairman and have an independent, non-executive Chairman of the Board. | |

| ● | Women comprise 37.5% of our Board slate. | |

| ● | All of our Directors and nominees are independent, other than our CEO. | |

| ● | Our Board is actively engaged in director succession planning and considers diversity in the selection criteria. |

| 3 |

Board Practices & Oversight

| ● | Regular executive sessions without management or non-independent directors present provide independent Directors an opportunity to meet in private. | |

| ● | The average attendance by directors at Board and Committee meetings was over 90%. | |

| ● | Oversight of risk management occurs within each Committee, as well as by the whole Board, and our Corporate Governance and Risk Assessment Committee (the “Governance and Risk Committee”) specifically assesses Company risks. | |

| ● | Our Corporate Governance Guidelines provide for consideration of average tenure of the Directors. |

Other Activities

| ● | We prohibit hedging and pledging of securities owned by Directors and employees. | |

| ● | Our Directors and Officers are required to retain ownership of a certain level of OSG stock in accordance with stock ownership guidelines. | |

| ● | Directors possess a wide range of financial, energy, governance and transportation services experience, resulting in diverse viewpoints, including service on other public and non-profit boards and prior service in the U.S. Congress. | |

| ● | Directors must inform the Governance and Risk Committee of any changes in their principal occupation and prior to accepting outside board membership. |

Executive Compensation

Consistent with our goal of securities owned by Directors and employees

Cybersecurity & Cyber Awareness

We understand that, in order to maintain competitiveness, OSG must utilize technology and adapt our practices to maximize efficiency in the conduct of our business. For example, the COVID-19 pandemic forced our business to adjust to the work-from-home environment and to utilize technological tools as much as possible. We have digitized most of our documents and we utilize several software applications for data analytics on our operations.

While we recognize the valuable benefits that “going digital” can provide, OSG also takes cybersecurity threats very seriously. We communicate with the Cybersecurity and Infrastructure Security Agency (CISA) and Federal Bureau of Investigation (FBI) on threats specific to the maritime industry and corporate operations. Over the last three years, OSG has not experienced any material cyber security violation or occurrence. We have in place a now-replaced employment agreement. Therefore, these Tables do not reveal the extentcyber security plan. Regular oversight is provided by our Governance and Risk Committee, including annual reviews of the changes we have executedcyber security plan, our current practices, and cyber security-related regulations that impact our Company.

Our cyber security plan is designed to restructureprovide malware protection and control to our executive compensation program. systems to protect the information and operating technology on board our vessels and in our corporate operations, providing for:

| ● | incident hotlines for suspicious cyber activity and/or breaches of security, | |

| ● | layered cybersecurity approaches, including next-generation software protections, and | |

| ● | annual information technology and cyber security training required for all employees. |

Environmental and Social Initiatives - Moving Energy with Integrity

OSG is committed to operating one of the safest, cleanest and most reliable fleets in the industry. Our industry is heavily regulated and our operations are in compliance with applicable regulations of the United States, the International Maritime Organization, the European Union and regional and local authorities on the prevention of oil spills, clean air and water, and carbon emissions.

| 4 |

The section "RevisionsGovernance and Risk Committee provides oversight of our environmental, social and governance policies and practices and its charter requires this Committee to conduct quarterly reviews of risks in these areas.

For the fiscal year ended December 31, 2021, OSG has published its 2021 Sustainability Report. The report highlights key actions our Company has made to 2019 Compensation Program" withindecrease our environmental impact, provide a safe and healthy work environment, promote a responsible and equitable workplace, and provide quality governance practices. Our policies relating to health and safety, environmental and social responsibility, and quality can also be found on our website. We have outlined a few key components of each of these policies below. To view the 2021 Sustainability Report or to view the policies in their entirety, please visit our website at www.osg.com/safety-and-environment.

Health and Safety Policy. We focus on providing healthy and safe working conditions for both our crews and shoreside employees and seek to accomplish these goals by:

| ● | Following our established Management System, which is designed to promote safe practices in ship operations, prevent damage to our vessels and the environment, prevent loss of human life and personal injury, and continuously improve the safety skills of personnel. | |

| ● | Maintaining and enforcing zero tolerance for any sexual assault or sexual harassment, the use of drugs or alcohol by seafarers and in the office workplace, or discrimination based on race, gender, disability, or religion. | |

| ● | Maintaining a Shipboard Occupational Health and Safety Program. | |

| ● | In response to the ongoing COVID-19 pandemic, establishing measures designed to protect the safety of our employees, both in the office and at sea. | |

| ● | Oversight by the Governance and Risk Committee of OSG’s safety performance and key performance indicators. |

Environmental Protection and Social Responsibility Policy. Our policies and operating practices include:

| ● | Endeavoring that all employees are informed, trained, and committed to complying with each vessel’s Ship Energy Efficiency Management Plan. | |

| ● | Requiring that all crew members certify their understanding and acceptance of OSG’s Environmental Protection and Social Responsibility Policy as a condition of employment. | |

| ● | Allocating significant capital to lessen our environmental impact and remain compliant with all applicable regulations, including: |

| ● | Installing ballast water treatment systems on our vessels; | |

| ● | Burning low sulfur content fuel in environmentally protected areas along the U.S. coastline; | |

| ● | Building newer, more efficient vessels to join our fleet; and | |

| ● | Oversight by our Governance and Risk Committee of the adequacy of OSG’s environmental initiatives and strategic planning. |

| 5 |

(PROPOSAL NO. 1)

The nominees for election at the Annual Meeting are listed below. The nominees were selected by the Board upon the recommendation of the Corporate Governance and Risk Assessment Committee. Unless otherwise directed, proxiesyproxies will be voted for the election of these nominees to serve until the 20202023 Annual Meeting of Stockholders of the CompanyOSG and until their successors are elected and qualify.

The Corporate Governance and Risk Assessment Committee considers the following criteria for identifying and recommending qualified candidates for membership on the Board, seeking to maintain within these criteria appropriate diversity of individuals on the basis of gender, ethnic heritage, international background and life experiences:

| ● | judgment, character, integrity, expertise, tenure, skills and knowledge useful to the oversight of OSG’s business; | |

| ● | status as “independent” or “audit committee financial expert” or “financially literate” as defined by the New York Stock Exchange (“NYSE”) and the SEC; | |

| ● | high level managerial, business or other relevant experience, including, but not limited to, experience in the industry in which OSG operates or in areas relevant to OSG’s operations; | |

| ● | changes in the board member’s principal occupation or business associations; | |

| ● | absence of conflicts of interest; | |

| ● | status as a U.S. citizen for compliance with the Jones Act; | |

| ● | ability and willingness of the candidate to spend a sufficient amount of time and energy in furtherance of Board matters; and | |

| ● | average tenure of the Board as a whole. |

As part of its annual assessment of Board size, structure and composition, the Corporate Governance and Risk Assessment Committee evaluates the extent to which the Board as a whole satisfies the foregoing criteria. The committee believes that the current nominees have the requisite character, integrity, expertise, skills, and knowledge to oversee the Company’s business in the best interests of the Company's stockholders. All the nominees named have been evaluated under the criteria set forth above and recommended by the Corporate Governance and Risk Assessment Committee toalso engages in succession planning and has considered several new candidates during this process. The Governance and Risk Committee has evaluated the fullnominees under the above criteria, and this Committee and the Board for election byrecommend that the stockholders elect all nominees at the Annual Meeting. The entire Board recommends that stockholders elect all nominees. All nomineesWe expect each nominee for election atas a Director to be able to serve if elected. If any nominee is not able to serve, the Annual Meeting were previously elected topersons appointed by the Board byand named as proxies in the stockholders atproxy materials may vote their proxies for substitute nominees, unless the 2018 Annual MeetingBoard chooses to reduce the number of Stockholders.

| 6 |

| Director | |||

| Business Experience during the Past Five Years and Other Information | |||

| Douglas D. Wheat | Mr. Wheat Skills and Qualifications Mr. Wheat’s finance and legal expertise and experience serving on numerous boards of directors make him a valuable asset to | ||

Age: 71 Director and Chairman since 2014 | |||

| Rebecca DeLaet | Ms. DeLaet was most recently the Chief Financial Officer of O.G. Energy (“OGE”) from 2018 until 2019. OGE is the energy arm of Ofer Global, a private portfolio of international businesses principally focused on shipping, real estate, energy, banking and investments. She served as a member of the Senior Management Committee of Ofer Global from 2004 to 2018. Ms. DeLaet also worked for Zodiac Finance, another division of Ofer Global, from 1990 to 2017 in positions of escalating authority as Vice President, Managing Director, and for the last seven years as President. She served on the Board of Directors and as Chair of the Audit Committee for both New Zealand Oil and Gas and Cue Energy Resources, publicly traded companies listed respectively on the New Zealand and Australian stock exchanges. She is currently the Director and Head of Finance for Team Image Synchronized Skating Team (a not for profit organization), a role which she has had since 2014. Skills and Qualifications Ms. DeLaet’s substantial experience in the shipping industry and her financial expertise qualify her for election to our Board. | ||

Age: 54 Director since 2020 Committee: Compensation |

| 7 |

| Director | |||

| Business Experience during the Past Five Years and Other Information | |||

| Joseph | Mr. Kronsberg Skills and Qualifications Mr. Kronsberg’s financial expertise and experience in investing and investment management make him a valuable asset to | ||

Age: 39 Director since 2015 | |||

| Anja L. Manuel | Former diplomat, author, and advisor on foreign policy, Anja Manuel Ms. Manuel is the author of She is the Executive Director of the Aspen Strategy Group and Aspen Security Forum — a premier bi-partisan forum on foreign policy in the U.S. From 2005-2007, she served as Earlier in her career, Ms. Manuel was an attorney at A cum laude Ms. Skills and Qualifications Ms. Manuel’s extensive experience in government relations, defense and governance matters makes her a valuable asset to | ||

Age: 47 Director since 2017 Committees: Governance and Risk (Chair) Audit | |||

| 8 |

| Director | Business Experience during the Past Five Years and Other Information | ||

| Samuel H. Norton | Mr. Norton was appointed Chief Executive Officer and President of Skills and Qualifications Mr. Norton’s substantial experience in the shipping industry | ||

Age: 63 Director since 2014 |

John P. Reddy | Mr. Reddy is currently a business consultant and private investor. From 2009 until Skills and Qualifications Mr. | ||

Age: 69 Director since 2018 Committees: Audit (Chair) Governance and Risk |

|

| Director | |||

| Business Experience during the Past Five Years and Other Information | |||

| Julie E. Silcock | Ms. Silcock has served as a Partner at CDX Advisors, a tech-enabled investment bank since June 2020. From 2009 to June 2020, she served as Managing Director and Co-Head of Southwest Investment Banking at Houlihan Lokey. Prior to that, she served as Managing Director and as Founder and Head of Southwest Investment Banking at Citigroup Global Markets, Inc. during her tenure from 2000 to 2009. Ms. Silcock earned her M.B.A. from Stanford Graduate School of Business and holds a B.A. degree from Princeton University. She currently also serves on the boards of MoneyGram International, Inc. (NASDAQ: MGI), a publicly traded fintech company, Q4 Inc. (TSX: QFOR) a publicly traded leading capital markets platform, JC Skincare, a privately held beauty company, and the U.S. Ski & Snowboard Foundation, a nonprofit organization that supports winter Olympic athletes. She was formerly on the Boards of MESA Airlines Inc. (NASDAQ: MESA), a publicly traded company, and GreenHunter Resources, Inc. (NYSE: GRH), a publicly traded water reclamation company. Skills and Qualifications Ms. Silcock has over 35 years of Capital Markets and M&A experience in the investment banking industry, bringing extensive financial knowledge and experience to the Board. Ms. Silcock also brings to the Board valuable knowledge of strategic considerations including M&A, corporate governance, compensation and similar issues from her current and prior work in investment banking and service on other publicly traded companies’ boards of directors. | ||

Age: 66 Director since 2018 Committees: Compensation (Chair) Audit | |||

| Gary Eugene Taylor | Mr. Taylor is a former member of the U.S. Congress, having served for 21 years until January 2011. Mr. Taylor Skills and Qualifications Mr. Taylor’s extensive expertise in shipping regulation makes him a valuable asset to | ||

| |||

Age: 68 Director since 2014 Committees: Governance and Risk Audit | |||

|

The Board recommends a vote "FOR"“FOR” the election of each of the nominees for director named in this Proxy Statement.

| 10 |

Corporate Governance Guidelines. The Board has adopted Corporate Governance Guidelines (the “Guidelines”) to assist insupport the effective functioning of the Board and its committees, to promote the interests of all stockholders, and to ensure a common set of expectations as to how the Board, its various committees, individual directors and management should perform their functions. The Board believes that ethics and integrity cannot be legislated or mandated by directive or policy and that the ethics, character, integrity and values of the Company'sOSG’s directors and senior management remain the most important safeguards in quality corporate governance. The Corporate Governance Guidelines provide criteria for the selection of directors that include diversity. They are posted on the Company'sOSG’s website, www.osg.com, and are available in print upon request. The website and the information contained on that site, or connected to that site, are not incorporated by reference in this proxy statement.Proxy Statement. Under the Corporate Governance Guidelines, each director is expected to attend all Board meetings and all meetings of committees of which the director is a member. Meeting materials are provided to Board and Committee members prior to meetings, and members are expected to review such materials prior to each meeting.

Board Leadership Structure. The Corporate Governance Guidelines provide that the Board selects the Chief Executive Officer ("CEO") of the CompanyOSG and may select a Chairman of the Board (the "Chairman") in the manner it considers in the best interests of the Company.OSG. The Guidelines provide that the Chairman may be a non-management director or the CEO.

OSG currently separates the role of CEO and Chairman, who is currently an independent Director. The CEO and the Chairman are in frequent contact with one another and with senior management of the Company.OSG. They provide advice and recommendations to the full Board for its consideration. They each review in advance the schedule of Board and committee meetings and establish the agenda for each Board meeting in order to ensure thataddress the interests and requirements of the stockholders, the directors and other stakeholders are appropriately addressed.stakeholders. The Board believes that the current leadership structure, including the individuals holding the leadershiprleadership positions, is in the best interests of stockholders.

The Board, primarily through its Corporate Governance and Risk Assessment Committee, (the "Governance and Risk Committee"), periodically reviews the Company’sBoard’s leadership structure to determine if it remains appropriate in light of the Company’sOSG’s specific circumstances and needs, current corporate governance standards, market practices and other factors the Board considers relevant. The

Board retains the right to combine the CEORefreshment and Chairman roles in the future if it determines that such a combination would be in the best interests of the Company and its stockholders.

Independence.Independence. Under the Corporate Governance Guidelines, which incorporate the standards established by the NYSE, the Board must consist of a majority of independent directors. As determined by the Board, as of the date of this Proxy Statement, all of the nominees other than Mr. Samuel H. Norton have been determined to be independent for purposes of service on the Board. No relationships were identified or considered that would bar any of them from being characterized as independent. EachThe Board also reviews, every quarter, the Board reviews relationships that directors may have with the CompanyOSG to determine whether there are any material relationships that would preclude a director from being independent. See "Related Party Transactions" below.Prior to June 2021, Mr. Kronsberg served on the Board as a representative of the interests of Cyrus Capital. Due to a change in his employment, there no longer is an affiliation between Mr. Kronsberg and Cyrus Capital. The Governance and Risk Committee has determined that Mr. Kronsberg remains independent.

Executive Sessions of the Board. To ensure free and open discussion and communication among the directors, the Corporate Governance Guidelines provide that directors meet in executive session without management present at each of the regular meetingsmeeting of the Board, and that at least one of such executive sessionssession is for only those directors who are independent.non-management directors. A non-executive Chairman must chair these executive sessions. Any non-management director can request that an additional executive session limited to independent directors be scheduled.

| 11 |

Board Oversight of Risk Management. While the responsibility for managing the Company'sOSG’s material risks lies with the management, team, the Board provides oversight of risk management directly and also through its committees. Each committee reports its activities and considerations to the full Board at every regularly scheduled quarterly meeting. The Board as a whole reviews the risks associated with the Company'sOSG’s strategic plan at an annual strategic planning session and periodically throughout the year as part of its consideration of the strategic direction of the Company.OSG.

At the committee level, the Audit Committee regularly reviews the financial statements and financial and other internal controls. Further, the Audit Committee schedules private sessions individually with certain members of management, with the

The Governance and Risk Assessment Committee manages risk associated with Board independence, corporate governance, and potential conflicts of interest, as well as oversight over non-financial risk assessmentsrisks associated with OSG’s operations. As part of risk management, the Company's operations.

The Human Resources and Compensation Committee (the "Compensation Committee"“Compensation Committee”) annually reviews executive compensation policies and practices, and employee benefits, and associated risks. The Compensation Committee conducts annual assessments of any risks associated with OSG'sOSG’s compensation policies and practices and has concluded that such policies and practices do not, individually or in the aggregate, create risks reasonably likely to have a material adverse impact on the Company.

Both the Audit and Compensation Committees also rely on the advice and counsel of the Company'sOSG’s independent registered public accountants and independent compensation consultants, respectively, to raise awareness of any risk issues that may arise during their reviews of the Company'sOSG’s financial statements, audit work and executive compensation policies and practices, as applicable.

Managing risk is an ongoing process inherent in all decisions made by management. The CompanyOSG has an enterprise risk management program that is designed to ensure that risks are taken knowingly and purposefully. Management is responsible for assessing such risks and related mitigation strategies for all material projects and initiatives of the CompanyOSG submitted for consideration ofby the Board. The risk assessment process identifiesseeks to identify the primary risks facing the CompanyOSG and seeks to prioritize these risks, as well as the actions necessary to mitigate and balance these risks.

Meetings of the Board. The Board held sixfive meetings during 2018.2021. Each directorsdirector attended at leastover 90% of the total number of meetings of the Board and Board committees of which the director was a member.

Annual Meetings of Stockholders. Directors are not required, but are strongly encouraged, to attend the annual meetingsmeeting in person or telephonically. All of the directors of the Company attended theour 2021 Annual Meeting of Stockholders in 2018.remotely.

Communications with Board Members. Interested parties, including stockholders, may communicate with any director, with the Chairman of the Board or with the non-management directors as a group by sending a letter to the attention of such director, or the non-management directors as a group, as the case may be, in care of the Company’sOSG’s Corporate Secretary, 302 Knights Run Avenue, Suite 1200, Tampa, Florida 33602. The Corporate Secretary opens, reviews, and forwards all such correspondence (other than advertisements and other solicitations) to directors and provides any communication addressed to the Board to the director(s) most closely associated with the nature of the request based on Committee membership and other factors.

Code of Business Conduct and Ethics; Other Compliance Policies. The Company OSG has adopted a Code of Business Conduct and Ethics, which is an integral part of the Company'sOSG’s compliance program and embodies the commitment of the CompanyOSG and its subsidiaries to conduct operations in accordance with the highest legal and ethical standards. This Code applies to all of the Company'sOSG’s officers, directors and employees. The CompanyOSG also has an Insider Trading Policy that prohibits the Company’sOSG’s directors and employees from purchasing or selling securities of the CompanyOSG while in possession of material non-public information or otherwise using such information for their personal benefit. The CompanyOSG has an Anti-Bribery and Corruption Policy that memorializes the Company'sour commitment to adhere faithfully to both the letter and spirit of all applicable anti-bribery legislation in the conduct of the Company'sOSG’s business activities worldwide. We have adopted a human rights statement, which can be found on OSG’s website. The Code of Business Conduct and Ethics, the Insider Trading Policy and the Anti-Bribery and Corruption Policy are posted on the Company'sOSG’s website, www.osg.com, and are available in print upon request. The website and the information contained on that site, or connected to that site, are not incorporated by reference in this Proxy Statement.

| 12 |

Prohibition Against Hedging and Pledging. The Company's OSG’s Insider Trading Policy prohibits the Company'sOSG’s directors and employees from hedging their ownership ofand pledging any securities of the Company,OSG, including by investing in options, puts, calls, short sales, future contracts, or other derivative instruments relating to CompanyOSG securities, regardless of whether such persons have material non-public information about the Company. The Company'sOSG. In addition, our Non-Employee Director Incentive Compensation Plan and Management Incentive Compensation Plan for Management prohibit incentive awards from being pledged.

Other Directorships and Significant Activities. The Company OSG values the experience directors bring from other boards of directors on which they serve, but recognizes that those boards also presentboard service presents significant demands on a director'sdirector’s time and availability and may present conflicts and legal issues. The Corporate Governance Guidelines provide that non-management directors refrain from serving on the boards of directors of more than four publicly-traded companies (other than the Company

The Corporate Governance Guidelines require the CEO and other members of senior management whether or not they are members of the Board, to receive the approval of the Governance and Risk Committee before accepting any outside board membership. The Corporate Governance Guidelines prohibit the CEO from serving on the board of directors of more than one publicly traded company (other than the CompanyOSG or a company in which the CompanyOSG has a significant equity interest).

If a director'sdirector’s principal occupation or business association changes substantially, that director is required by the Corporate Governance Guidelines to inform the Chairman of the Governance and Risk Committee of the change and offer to resign from the Board. In such case, such Committee must recommend to the Board the action, if any, to be taken with respect to the offer of resignation, taking into account the appropriateness of continued Board membership.

Committees

The CompanyBoard has three standing committees of its Board:committees: the Audit Committee, the Governance and Risk Committee, and the Compensation Committee. Each of these committees has a charter that is posted on the Company'sOSG’s website, www.osg.com, and is available in print upon request.

Audit Committee. The Audit Committee is required to have no fewer than three members, all of whom must be and are independent directors in accordance with the SEC and NYSE rules, as well as under the standards set forth in the Company’s Corporate Governance Guidelines. During 2018,2021, the Audit Committee consisted of Mr. John P. Reddy (Chair) (from his appointment in June 2018), Ms. Anja L. Manuel, and Ms. Julie E. Silcock (from her appointment in June 2018).Silcock. The Board affirmatively determined that each member of the Audit Committee was independent, and determined that Mr. Reddy and Ms. Silcock are audit committee financial experts, and that Ms. Manuel is financially literate, both as defined by rules of the SEC and NYSE. The Audit Committee met 10eight times in 2018.2021. The Audit Committee meets frequently in executive session, without any members of management present, to confer with the independent registered public accounting firm and internal auditors.

The Audit Committee oversees the Company'sOSG’s accounting, financial reporting process, internal controls, and audits and consults with management, internal auditors, and the Company'sour independent registered public accounting firm on, among other things, matters related to the annual audit, the accounting principles applied to the financial statements, and the oversight of financial risk associated with the Company'sOSG’s operations.

The Audit Committee retains theOSG’S independent registered public accounting firm, subject to stockholder ratification (although the stockholder vote is not binding). The Audit Committee may in its sole discretion terminate the engagement of the firm and direct the appointment of another independent auditor at any time during the year if it determines that such an appointment would be in the best interests of the CompanyOSG and itsour stockholders. The Audit Committee maintains direct responsibility for the compensation and oversight of the independent registered public accounting firm and evaluates its qualifications, performance, and independence. The Audit Committee has established policies and procedures for the pre-approval of all services provided by the independent registered public accounting firm.

| 13 |

Corporate

Governance and Risk Assessment Committee. The Governance and Risk Committee is required to have no fewer than three members, all of whom must be and are independent directors under the standards set forth in the Corporate Governance Guidelines. During 2018,2021, the Governance and Risk Committee consisted of Ms. Anja L. Manuel (Chair), and Messrs. John P. Reddy (from his appointment in June 2018) and Gary E. Taylor. The Board affirmatively determined that each member of the Governance and Risk Committee was independent. The Committee met five times in 2018.

The Governance and Risk Committee evaluates prospective nominees for election to the Board who are identified or referred by other Board members, management, stockholders or external sources and all self-nominated candidates, and recommends to the Board those individuals who the Governance and Risk Committee believes are best qualified to serve on the Board. The Governance and Risk Committee uses the same criteria for evaluating candidates nominated by stockholders and self-nominated candidates as it does for those proposed by other Board members, management, and search consultants. This Committee also develops and recommends to the Board the Corporate Governance Guidelines and leads the annual review of the Board'sBoard’s performance.

The Governance and Risk Committee provides oversight over the non-financial risks associated with OSG’s operations, including environmental, social, and governance strategies, policies and practices, cybersecurity risk mitigation, as well as our vessels’ adherence to environmental and regulatory requirement.

Compensation Committee. The Compensation Committee is required to have no fewer than three members, all of whom must be and are independent directors under the standards set forth in the Company’s Corporate

The Compensation Committee establishes, oversees, and carries out the Company’sOSG’s compensation philosophy and strategy, and assesses compensation-related risks. It implements the Board'sBoard’s responsibilities relating to compensation of the Company’sour executive officers and ensuresseeks to ensure that they are compensated in a manner consistent with the philosophy and competitive with its peers. This Committee monitors and oversees the preparation of the Compensation Discussion and Analysissection entitled “How We Compensate Our Executives” for inclusion in theOSG’s annual proxy statement and prepares an annual report on executive compensation.

Related Party Transactions

Related party transactions may present potential or actual conflicts of interest andor create the appearance that decisions are based on considerations other than the best interests of the CompanyOSG and itsour stockholders. Our Code of Business Conduct and Ethics requires all directors, officers and employees who may have a potential or apparent conflict of interest to disclose fully all the relevant facts to OSG'sOSG’s legal department any time they arise. Every quarter, our Corporate Secretary inspects whether any related party transactions have occurred and reports the findings to the Audit Committee. In addition to this reporting requirement, to affirmatively seek to identify related party transactions, each year we require our directors and executive officers to complete questionnaires identifying any transactions with the Company in which the director or officer has an interest. Any proposed transaction or relationship that could be viewed as a potential conflict is carefully reviewed, with those determined to be related party transactions reported to the Board for consideration. If the related party is a director, that director will not participate in the discussion. In deciding whether to approve the proposed related party transaction, the Board will determine whether the transaction is on terms that could be obtained in an arm'sarm’s length transaction with an unrelated third party and if the transaction is in the best interest of the stockholders and the Company.OSG. If the related party transaction is not on such terms, it will not be approved. In addition, every quarter, our Corporate Secretary determines whether any related party transactions have occurred and reports the findings to the Audit Committee. In addition to this reporting requirement, in order to affirmatively seek to identify related party transactions, each year we require our directors and executive officers to complete questionnaires identifying any transactions with OSG in which the director or officer has an interest. There were no related party transactions in 2018.2021.

| 14 |

Our non-employee directors receive annual cash retainers each year. Followingyear, with additional cash retainers for service as a reviewcommittee member or chair or for services as Board Chair. In addition, each non-employee director receives an annual award of market data for director compensation,restricted stock units, or RSUs, under the Board determined it be in the best interest of the Company to reduce the compensation paid to OSG's non-management directors. In June of 2018, the Company adopted new annual cash retainer rates, which were effective as of July 1, 2018:

| Board Position | Annual cash retainer from June 2017 until June 2018 | Annual cash retainer since July 1, 2018 | Annual stock awards from June 2017 until June 2018 | Annual stock awards since July 1, 2018 |

| Board membership (non-management directors only) | $80,000 | $65,000 | $100,000 | $85,000 |

| Board Chair | $172,000 | $115,000 | $180,000 | $127,000 |

| Audit Committee Chair | $20,000 | $18,000 | ||

| Audit Committee member | $10,000 | $9,000 | ||

| Compensation Committee Chair | $20,000 | $14,000 | ||

| Compensation Committee member | $10,000 | $8,000 | ||

| Governance and Risk Committee Chair | $13,000 | $11,000 | ||

| Governance and Risk Committee member | $6,500 | $7,000 | ||

For 2021, director compensation was the same as in the prior year. The following sets forth the annual cash retainers and RSU values for our non-employee directors:

| Board Position | Annual cash retainer $ | Annual RSU awards | ||||||

| Board membership (non-management directors only) | 65,000 | 85,000 | ||||||

| Board Chair | 115,000 | 127,000 | ||||||

| Audit Committee Chair | 18,000 | n/a | ||||||

| Audit Committee member | 9,000 | n/a | ||||||

| Compensation Committee Chair | 14,000 | n/a | ||||||

| Compensation Committee member | 8,000 | n/a | ||||||

| Governance and Risk Committee Chair | 11,000 | n/a | ||||||

| Governance and Risk Committee member | 7,000 | n/a | ||||||

| Transaction Committee* member | * | n/a | ||||||

* During 2021, in response to an offer made to purchase OSG, the Board formed, temporarily, a Transaction Committee. The members (Mr. Wheat, Ms. DeLaet, and Ms. Silcock) received $5,000 per month for June, July, August and September.

The following table shows the total compensation paid to the Company'sOSG’s non-employee directors during 2018:

| Name | Retainers earned or Paid in Cash ($)(1) | Stock Awards ($) FMV(2) | Total ($) | |||||||||

| Rebecca DeLaet | 74,750 | 85,000 | 159,750 | |||||||||

| Joseph I. Kronsberg(3) | 32,500 | 85,000 | 117,500 | |||||||||

| Anja Manuel | 85,000 | 85,000 | 170,000 | |||||||||

| John P. Reddy | 90,000 | 85,000 | 175,000 | |||||||||

| Julie E. Silcock | 108,000 | 85,000 | 193,000 | |||||||||

| Gary Eugene Taylor | 80,000 | 85,000 | 165,000 | |||||||||

| Douglas D. Wheat | 135,000 | 127,000 | 262,000 | |||||||||

| Name | Retainers earned or Paid in Cash ($)(1) | Stock Awards ($) FMV | Total ($) | ||||

Joseph I. Kronsberg(3) | 72,500 | 85,000 | (2) | 157,500 | |||

| Anja Manuel | 89,000 | 85,000 | (2) | 174,000 | |||

John P. Reddy(4) | 45,000 | 85,000 | (2) | 130,000 | |||

Julie E. Silcock(4) | 44,000 | 85,000 | (2) | 129,000 | |||

| Gary Eugene Taylor | 93,250 | 85,000 | (2) | 178,250 | |||

Ty E. Wallach(5) | 18,250 | 63,750 | (2)(5) | 82,000 | |||

| Douglas D. Wheat | 143,500 | 127,000 | (2) | 272,500 | |||

| Former Members of the Board | |||||||

Timothy J. Bernlohr(6) | 55,000 | 55,000 | |||||

Ronald Steger(6) | 53,250 | 53,250 | |||||

| (1) | Consists of annual retainers for Board and/or Committee service. |

| (2) | The grants, made |

| (3) | In accordance with Mr. |

Capital Partners, until May 31, 2021, when Mr. Kronsberg became no longer employed by Cyrus Capital Partners.

OSG encourages stock ownership by directors in order to align their interests with those of directors with the long-term interests of the Company'sour stockholders. To further stock ownership by directors, the Board believes that regular grants of equity compensation should be a significant component of director compensation.

The Board has in place stock ownership guidelines for non-employee directors. Under the stock ownership guidelines, each non-employee director is expected within five years of becoming a director to own shares of the Company'sOSG’s Class A Common Stock whosewith a market value equalsequal to at least three times the annual cash retainer for Board service. The Directors are in compliance with these guidelines.

| 15 |

This Compensation Discussion and Analysis ("CD&A")section provides information regarding the compensation program for 20182021 for individuals who served as executive officers and who are listed in the Summary Compensation Table (collectively, the "Named“Named Executive Officers"Officers” or "NEOs"“NEOs”). Our NEOs for 20182021 are:

| Name | ||

| Position | ||

| Mr. Samuel H. Norton | President, Chief Executive Officer and Director | |

| Mr. Richard L. Trueblood | Vice President and Chief Financial Officer | |

| Mr. Patrick J. | Vice President and Chief Operations Officer | |

| Mr. Damon M. Mote | Vice President and Chief Administrative Officer | |

As noted elsewhere in this Proxy Statement, OSG qualifies as a “Smaller Reporting Company,” or “SRC,” under SEC rules. As a Smaller Reporting Company, we are permitted to provide reduced disclosures in this Proxy Statement, including those relating to executive compensation. Among other things, we are no longer required to have a Compensation Discussion and Analysis. Nevertheless, we are providing the following information to be transparent to our stockholders on how we compensate our executives. This section describes our compensation philosophy, the objectives of our executive compensation program and policies, the elements of the compensation program and how each element fits into our overall compensation philosophy and strategy.

Executing on Strategy: Our 20182021 Performance

The COVID-19 pandemic continued to executehave substantial impacts on the world and on OSG’s business during 2021. The performance measures for our compensation program for 2021 were set by our Compensation Committee in the midst of significant uncertainty and inability to predict the length and extent of the impacts of the pandemic on our long-term strategy, resulting in greater certaintybusiness. Our NEOs acted nimbly and increased visibility in our financialeffectively to protect the safety and operational performance for 2019. We improved our fleet's earning power and reduced our spot market exposure by securing profitable time charters for the majorityhealth of our fleet throughout 2019,crew members and by reducingshoreside employees and refinancingto continue to provide critical, high-quality services to our debt. Prevailing rates recently obtained forcustomers. The NEOs were also successful in focusing on the execution of our conventional tankers are approximately 30% abovelong-term business strategies. We were able to contain our 2018 average, a signal that bodes well for a business characterized by high operating leverage. We further cemented our leadership position acrosscosts and achieve synergies with the niche businesses inintegration of Alaska Tanker Company, LLC, which we operate, maintaining our foundation of strong,acquired in 2020. We obtained long term financial commitments with stable contracts as we explore opportunitiesfinancial covenants that will enable us to grow. We succeededinvest in reducing costs and improving efficiencies across our organization without compromising our commitment toOSG’s future. Always, safety and quality of operational performance. Safety and quality remainare the key focuses of our operations. Our corporate culture is geared towards continuously seeking to achieve the highest standards in protecting the environment and ensuring the health and safety of all of our employees. We believe successissued a Sustainability Report in 2021 and in 2022 contemporaneously with our Annual Report and this goal is paramount in allowingProxy filing which states our commitment to reducing our carbon footprint and to making cultural changes that will provide benefits to our human capital.

The narrative that follows describes the Companycompensation program for 2021, which was designed by our Compensation Committee to sustain its good standing in the community ofincentivize our customers,executives to achieve our peersstrategic and our regulators.

Say on Pay Results - Consideration of Stockholder Feedback

At our 20182021 annual meeting of stockholders, 64.24%99.27% of the stockholders who voted on the say-on-pay proposal were in favor of our executive compensation program. In response toWe believe that this 2018 advisory vote, as well as a desire to exchange views withlevel of support reflects our stockholders, the Company, with the strong support of the Board, reached out to some of our larger stockholders to gain insight into the concerns they had with our compensation practices. In general, the feedback we received related to concerns with our CEO's compensation structure, particularly the lack of long-term, performance-based incentives, as well as disclosures of our compensation goalsstockholders’ belief that were not sufficiently transparent. In response to this feedback, we implemented a number of key changes to our compensation program is effective and practices specifically to address and ameliorate these concerns. Followingreasonable.

Summary of the implementation of these changes, we are again reaching out to the stockholders to discuss our revised CEO compensation package and the further improvements we have implemented in 2019 to our compensation structure (see "Revisions made to 20192021 Compensation Program").

The 2021 compensation program mirrored the stockholders to whom we spoke expressed differing viewpoints, they were supportive of the revisions we have now made. We believe that we have addressed the primary concerns raised by our stockholders.structure and metrics used in 2020. The modifications we have made affect the compensation packages of our CEO and our other NEOs, and include the following:

| 16 |

The following table below summarizesis the mix of compensation levels approved by the Compensation Committee for 2019.

| Short Term Incentives | Long Term Incentives | |||||||||||||||

| Officer | 2021 Base Salary | Annual Cash Incentives as a % of salary | Annual Equity Grants as a % of salary | Special 2021 Equity Grant as a % of salary | ||||||||||||

| Norton | $ | 425,000 | 100% | 200% | 115% | |||||||||||

| Trueblood | $ | 300,000 | 60% | 85% | 85% | |||||||||||

| O’Halloran | $ | 265,000 | 60% | 85% | 85% | |||||||||||

| Mote | $ | 265,000 | 60% | 85% | 85% | |||||||||||

Our Executive Compensation Philosophy and Practices

We believe that a well-designed compensation program is a powerful tool to attract, motivate, retain and reward top executive and managerial talent and that it should also align the interests of our executives with those of our stockholders. We have structured our compensation program to drive and support these objectives:

| Overall Objectives | – | Attract, motivate, retain and reward | |||

| – | Align the interests of our executives with those of our stockholders. | ||||

| – | Support the long-term retention of | ||||

| – | Compensate each executive within the range of competitive practice (1) within the marketplace for talent in which we operate; (2) based upon the scope and impact of his or her position as it relates to achieving our corporate goals and objectives; and (3) based on the potential of each executive to assume increasing responsibility within | ||||

| – | Discourage excessive or imprudent risk-taking. | ||||

| Reward the achievement of both the short-term and long-term strategic objectives necessary for sustained optimal business performance. | |||||

| Pay Mix Objectives | – | Provide a mix of both fixed and variable (“at-risk”) compensation, each of which has a different time horizon and payout form (cash and equity), to reward the achievement of annual and sustained, long-term performance. | |||

| – | Use our incentive compensation program and plans to align the interests of our executives with those of our stockholders by linking incentive compensation rewards to the achievement of performance goals that maximize stockholder value by: | ||||

| * | seeking to ensure that our compensation program is consistent with, and supportive of, our short- and long-term strategic, operating and financial objectives. | ||||

| * | placing a significant portion of our executives’ compensation at risk, with payouts dependent on the achievement of both corporate and individual performance goals, which are set by the Compensation Committee. | ||||

| * | encouraging balanced decision-making by employing a variety of performance measures to avoid over-emphasis on the short-term or any one metric. | ||||

| 17 |

Executive Compensation Practices: What We Do and What We Do Not Do

The following table summarizes some of the key features of our executive compensation program.

| What We Do | What We | |||

Utilize compensation benchmarking - |

| No hedging and no pledging - Board members, | ||

| No perquisites - | |||

| ✔ | Pay for performance - |

| No automatic or guaranteed pay - | |

| No tax gross ups - | |||

| ✔ | Compensation recoupment policies - We maintain a strict compensation recoupment (clawback) |

| No special retirement programs - | |

| ✔ | Stock ownership guidelines - Our |

| No stock option re-pricing - We do not allow discounted stock options, reload stock options or stock option re-pricing without stockholder approval. | |

| ✔ | Independent compensation consultant - The |

| No dividends on unvested equity- Dividend equivalents are accrued but not paid on all unvested equity grants. For Performance-based RSUs | |

| 18 |

Compensation Risk Mitigation

The Compensation Committee annually assesses risks that may be present in our compensation program and has concluded that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company.OSG. Because the Compensation Committee believes that a significant portion of our NEOs’ total compensation should be variable and “at risk”, the Committee uses a balancemix of performance measures and metricsgoals in our incentive compensation program that seeks to balance our short- and long-term goals and to discourage excessive or inappropriate risk-taking by eliminating any inducement to over-emphasize one goal to the detriment of others. To further mitigate excessive risk taking, we have adopted the following:

| Stock Ownership Guidelines | Our Corporate Governance Guidelines include stock ownership guidelines for our directors and executives. The minimum levels of ownership for each position are as follows: | ||||

| Value if Shares Owned (Multiple of | |||||

| Position | Salary / Annual | ||||

| Non-Employee Directors | 3x (Annual Retainer) | ||||

| President / Chief Executive Officer | 5x | ||||

| Chief Financial Officer | 3x | ||||

| 1.5x | |||||

Directors and | |||||

For purposes of these stock ownership guidelines, ownership comprises all shares of Class A Common Stock held by the director or officer, their spouse, and | |||||

| - Shares deemed to be beneficially owned under federal securities laws; | |||||

| - Any time-based restricted stock or RSUs awarded (whether or not vested); | |||||

| - Any vested, in-the-money stock options; and | |||||

| - Any stock held for the | |||||

| Stock Holding Requirements | Mr. Norton must hold all stock that was granted with immediate vesting for three | ||||

| Recoupment | Our Incentive Compensation Recoupment Policy | ||||

| No Hedging | Our Insider Trading Policy prohibits hedging, including investing in options, puts, calls, short sales, futures contracts, or other derivative instruments relating to Company securities, regardless of whether such persons have material nonpublic information about | ||||

| No Pledging | Our Insider Trading Policy and our stock incentive plans prohibit pledging by our non-employee directors and all | ||||

| Equity Plan Features | Our stock incentive plans do not permit repricing or cash buyouts of underwater options or stock appreciation rights without stockholder approval. The Compensation Committee believes these plans are structured so as to avoid problematic pay practices and do not contain features that could be detrimental to stockholder interests. | ||||

| 19 |

Roles in Setting Executive Compensation

Role of the Compensation Committee

The primary role of our Compensation Committee, which consists entirely of independent directors, is to establish our compensation philosophy and strategy and to provide that all of our executives are compensated in a mannerwith compensation opportunities consistent with the articulated philosophy and strategy. The Compensation Committee takes many factors into account when making compensation decisions with respect to the executive officers,our NEOs, including the individual’s performance and experience; the ability of the individual to affect our long-term growth and success; ourOSG’s overall performance; internal equity among the NEOs; and external, publicly available market data on competitive compensation practices and levels. The Compensation Committee typically will establish the annual compensation program during the first quarter of each fiscal year, setting specific annual and long-term Company goals and designing the compensation program for that year to support and reward the achievement of those goals. In setting the compensation for our NEOs, other than the CEO, the Compensation Committee considers, among other things, the recommendations of our CEO. The Committee is, however, solely responsible for making the final decision on the compensation of our NEOs.

The Compensation Committee meets in executive session at least on a quarterly basis but as often as necessary or indicated by events for discussion or decisions regarding executive compensation.

Role of Compensation Consultant

The Compensation Committee engaged Lyons Benenson & Company Inc. (“LB&Co.”&Co”) in 20182021 as its independent compensation consultant to assist and advise the Committee on all aspects of the Company’sOSG’s executive and director compensation programs and related corporate governance matters. LB&Co.&Co does not provide other services to the CompanyOSG or its NEOs. LB&Co.&Co was retained directly by the Compensation Committee, which, in its discretion, has the sole authority to select, approve, retain, terminate, and oversee its relationship with its consultant. In selecting its compensation consultant, the Compensation Committee considered the independence of LB&Co.&Co in accordance with the standards of the NYSE, applicable rules and regulations of the SEC and other laws relating to the independence of advisors and consultants. The Committee determined that the work of LB&Co.&Co did not raise any conflict of interest in 2018.

A representative of LB&Co. attended or participated by teleconference in all meetings of the Compensation Committee in 2018.

Role of the CEO in Setting Compensation

Decisions relating to the CEO’s performance and compensation are made by the Compensation Committee in executive session without the CEO present.session. In making determinations regarding compensation for the other NEOs, the Committee generally considers the recommendations of the CEO and the advice received from LB&Co. In making his recommendations, the CEO evaluates the performance of each executive, considers each executive’s compensation in relation to our other officers and executives and assesses retention risks. The Compensation Committee then reviews, modifies (as appropriate) or approves these recommendations and either reports the results to the Board or recommends actions for the Board to approve.

| 20 |

Components of companies that the Compensation Committee believes to be an appropriate compensation reference group (the “Peer Group”). The Committee periodically reviews the Peer Group to affirm that it is comprised of companies that are similar to us in terms of industry focus, scope of operations, size (in terms of revenues and market capitalization), and the competitive marketplace for talent.

| Company | Revenue for FY2017 ($ in millions) | Company | Revenue for FY2017 ($ in millions) | |||||

| Blueknight Energy Partners, L.P. | $ | 182 | Martin Midstream Partners L.P. | $ | 946 | |||

| Eagle Bulk Shipping Inc. | $ | 237 | Matson, Inc. | $ | 2,047 | |||

| Genco Shipping & Trading Limited | $ | 210 | SemGroup Corporation | $ | 2,082 | |||

| Holly Energy Partners, L.P. | $ | 454 | SEACOR Holdings Inc. | $ | 578 | |||

| Hornbeck Offshore Services, Inc. | $ | 191 | Seacor Marine Holdings Inc. | $ | 174 | |||

| International Seaways, Inc. | $ | 290 | TC PipeLines, L.P. | $ | 546 | |||

| Kirby Corporation | $ | 2,214 | ||||||

| Median revenues of Industry Peer Group | $ | 454 | ||||||

| 2018 Florida Market Peer Group | ||||||||

| Company | Revenue for FY2017 ($ in millions) | Company | Revenue for FY2017 ($ in millions) | |||||

| Beasley Broadcast Group, Inc. | $ | 232 | Perry Ellis International, Inc. | $ | 861 | |||

| Cross Country Healthcare, Inc. | $ | 865 | PetMed Express, Inc. | $ | 249 | |||

| FARO Technologies, Inc. | $ | 361 | Rayonier Advanced Materials Inc. | $ | 961 | |||

| HCI Group, Inc. | $ | 244 | RTI Surgical, Inc. | $ | 280 | |||

| Health Insurance Innovations, Inc. | $ | 251 | Ruth's Hospitality Group, Inc. | $ | 415 | |||

| Heritage Insurance Holdings, Inc. | $ | 407 | SEACOR Holdings Inc. | $ | 578 | |||

| Kforce Inc. | $ | 1,358 | Sun Hydraulics Corporation | $ | 343 | |||

| Marine Max, Inc. | $ | 1,052 | Superior Group of Companies, Inc. | $ | 267 | |||

| NeoGenomics, Inc. | $ | 259 | The Hackett Group, Inc. | $ | 263 | |||

| NV5 Global, Inc. | $ | 333 | United Insurance Holdings Corp. | $ | 654 | |||

| Median revenues of Florida Market Peer Group | $ | 352 | ||||||

The Compensation Committee reviews each element of compensation annually to ensure alignment with our compensation philosophy and objectives, as well as to assess our executive compensation program and levels relative to the competitive landscape. Our executive compensation program consists of the following:

| Elements | What It Is | Objective/ Purpose | ||||

| Fixed | Base Salary | Fixed amount | Rewards scope of responsibility, experience and individual performance. | |||

| At-Risk | Annual Incentive Compensation | At-risk | Promotes strong business results by rewarding value drivers, without creating an incentive to take excessive risk. | |||

| Serves as key compensation vehicle for rewarding results and differentiating individual performance each year. | ||||||

| Long-Term Incentive Compensation (Equity) | Equity grants are | Performance metrics create incentives to outperform peers | ||||

| TSR PRSUs are | Three-year performance period supports retention and aligns pay with performance over an extended period of time. | |||||

ROIC PRSUs are | Provides executives with a significant stake in the long-term financial success of | |||||

Special 2021 Grant payable in shares of Class A Common Stock upon vesting based on attainment of key 18-month operational and financial measures | This grant increased the percentage of our equity grants that are performance-based and at risk for 2021. The performance criteria focused our NEOs on the matters that were of greatest importance to OSG during the uncertain times related to the pandemic that are able to be affected by our NEOs’ performance. | |||||

Time-based RSUs | Promotes | |||||

| Benefits | Retirement, Health and Welfare | 401k plan with | Provides market competitive benefits to attract and retain top talent. | |||

| Competitive welfare benefits | ||||||

| Severance | Severance Arrangements - Termination Due to Change in Control (Double-Trigger) | Severance and related benefits paid upon termination without cause or resignation for good reason following a change in control | Preserves objectivity when considering transactions in the best interest of stockholders. Equity provisions keep each executive whole in situations where shares may no longer exist, or awards cannot otherwise be replaced. | |||

| Accelerated equity vesting upon termination post-change in control | Retains executives through a change in control. | |||||

Allows | ||||||

| Assists in attracting top talent. | ||||||

| Severance Arrangements - Termination without cause or for Good Reason | Severance and related benefits paid upon termination without cause or resignation for good reason | The Assists | ||||

| 21 |

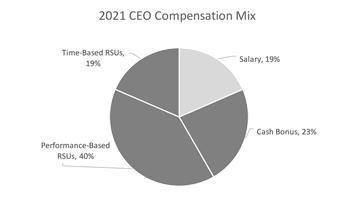

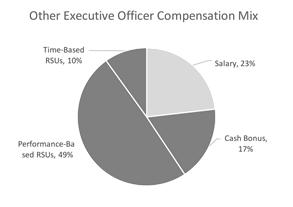

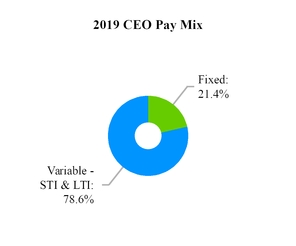

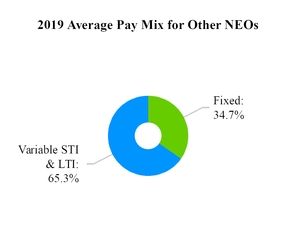

Named Executive Officer Compensation Mix

The charts below depict the mix of those elements of the 2021 compensation program that are at-risk, such as the cash bonus under our Annual Incentive Program and time and performance-based equity grants, compared to the fixed base salary for the CEO and the other executive officers.

|  |

Base Salary

We strive to pay base salaries that are market-competitive for a company of our size so as to attract and retain talented executives and to provide a secure fixed level of compensation. The Compensation Committee annuallyregularly reviews the base salaries of our executive officers and compares them to the salaries of senior management among the peer groupsgroup as well as other regional market data, bearing in mind that total estimated direct compensation opportunity is the principal comparative measure of the competitiveness of our program. Based on its own experience and such comparison, the Compensation Committee determines whether the

2021 Annual adjustments in base salary, if any, take into account individual performance, prior experience, position duties and responsibilities, internal equity and external market practices. The Compensation Committee largely relies on the CEO’s evaluation of each executive’s performance (other than his own) in deciding whether to approve merit increases for any executives in a given year.

At our 2019 Annual Meeting of Stockholders, our shareholders approved the Compensation Committee.

| Name | Position | 2018 Annual Salary Rate | % increase from 2017 |

| Norton | President, CEO and Director | $395,000 | N/A |

| Trueblood | VP and CFO | $256,000 | N/A |

| O'Halloran | VP and Chief Operations Officer | $230,000 | 12% |

| Mote | VP and Chief Administrative Officer | $230,000 | 12% |

| Allan | VP, General Counsel and Corporate Secretary | $250,000 | 9% |

The Annual Incentive Program for 2021 (“Annual Incentive Program”) is consistent with our compensation philosophy, regarding Mr. Norton’smeets the requirements of the Plan, and is in line with compensation and re-designs his compensation package going forward. Please see "

The following description summarizes Mr. Norton’s compensation as it was determinedthe design of the Annual Incentive Program for the NEOs, which is the same design adopted by the Compensation Committee at the beginning of the performance period in 2018 and as agreed in the 2016 CEO Employment Agreement.

| ● | A pool of funds was established using the metric of FCF, a non-GAAP measure, with the amount of the pool calculated based on a pre-determined formula, setting forth threshold, target and maximum levels of achievement, and containing a SG&A multiplier (the “Pool”). We define FCF as EBITDA less capital expenditures. See the section “Non-GAAP Financial Measures” for further details. | |

| ● | The FCF funding formula is based upon the | |

| ● | The calculation of the |

| acquisitions or divestitures. | |

● |

| Target achievement levels for each participant in the |

Achievement of $27.5 million and $325 million resulting in a reduction in interest expenses.

| Name | 2018 Target Bonus | Target Bonus $ | Actual Achievement % | Actual Payment | ||||

| Trueblood | 15% | $ | 38,400 | 25% | $ | 64,000 | ||

| O'Halloran | 15% | $ | 34,500 | 22.5% | $ | 51,750 | ||

| Mote | 15% | $ | 34,500 | 22.5% | $ | 51,750 | ||

| Allan | 15% | $ | 37,500 | 20% | $ | 50,000 | ||

| Participant | % Participation | First Half (earned) | Second Half (if earned) | Total (if earned) | ||||||

| Norton | 35% | $ | 921,225 | $ | 921,225 | $ | 1,842,450 | |||

| Trueblood | 15% | $ | 394,811 | $ | 394,811 | $ | 789,622 | |||

| O'Halloran | 12.5% | $ | 329,009 | $ | 329,009 | $ | 658,018 | |||

| Mote | 12.5% | $ | 329,009 | $ | 329,009 | $ | 658,018 | |||

| Allan | 5% | $ | 131,604 | $ | 131,604 | $ | 263,208 | |||

| Remainder deposited in the Annual Bonus Pool to be distributed to other employees (non NEOs) at the discretion of the CEO | 20% | $ | 526,414 | $ | 526,414 | $ | 1,052,828 | |||

| Total | 100% | $ | 2,632,072 | $ | 2,632,072 | $ | 5,264,144 | |||

| NEO | GOALS | TARGET | ACHIEVEMENT LEVEL | |||

| Norton | Maximize the utilization of the fleet and TCE Results Sustain liquidity access Promote safety culture and environmental stewardship Lead the Environmental, Social and Governance (“ESG”) strategy Lead the implementation of the enterprise software system Achieve SG&A synergies | 100% of Base Salary | 125% of Target | |||

| Trueblood | Sustain liquidity access and efficient capital management Lead the long-term financial strategy Prepare for the transition of the accounting and financial control system to the new enterprise software system | 60% of Base Salary | 125% of Target | |||

| O’Halloran | Lead safety and operational performance across the fleet and harmonize best practices Lead the development of strategies to reduce OSG’s carbon footprint Oversee the transition of operations, quality and purchasing departments to the new enterprise software system Maximize the efficient management of dry dock costs | 60% of Base Salary | 125% of Target | |||

| Mote | Lead the implementation of the enterprise software system Take measures to minimize the impact of the COVID-19 pandemic Lead the collective bargaining strategies Implement enhancements to the operations of the insurance department | 60% of Base Salary | 125% of Target |

Long Term Incentives

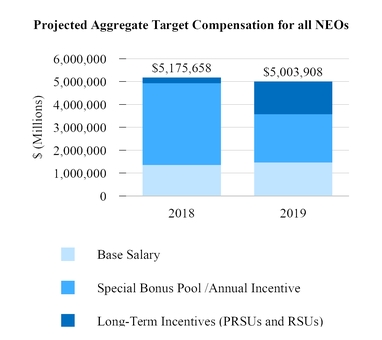

The Special Bonus Pool payment of $2,632,072 in respect of fiscal 2018 represented approximately 22% of the aggregate net savings in SG&A achieved during the two year performance period of fiscal 2017 and 2018. If targets are met during fiscal 2019, the total Special Bonus Pool payment earned will rise to approximately 26% of the aggregate net savings in SG&A achieved across fiscal 2017, 2018 and maintained in 2019, without considering the future impact of the continuing reduction in the Company’s cost structure. The aggregate net savings include the following SG&A reductions in actual expenses:

Due to the impact of the COVID-19 pandemic on OSG’s business, the Compensation Committee adopted the Special 2021 Grant, a one-time, performance-based equity grant incremental to the equity grants tied to TSR and ROIC metrics. The effect of this Special 2021 Grant is an increase in the percentage of equity grants that are performance-based and at risk. The Committee determined that the performance of the NEOs merited this grant and would provide an incentive tied to performance criteria that would focus the NEOs on the matters that are of greatest importance to OSG and its continued operational and financial success, and that were within their ability to control or influence.

| 23 |

Each type of grant and the grant date values are describedshown in the table below. The grant date value for equity was set at 50% of the NEO base salary. Please refer to the Summary Compensation Table, Grants of Plan Based Awards Table and the Outstanding Equity Awards at Fiscal Year-End Table for additional details regarding these grants:

| NEO | Total Grant Date Value | Time-Based RSUs (1)(2) | Performance-Based RSUs (1) (3) |

| Norton | n/a | n/a | n/a |

| Trueblood | $128,000 | $64,000 | $64,000 |

| O'Halloran | $115,000 | $57,500 | $57,500 |

| Mote | $115,000 | $57,500 | $57,500 |

| Allan | $125,000 | $62,500 | $62,500 |

| NEO | Total Grant Date Value (1) (2) | Time-Based RSUs (1) (3) | Performance-Based RSUs TSR/ROIC (1) (4) | Performance-Based RSUs Special 2021 Grant (1) (5) | ||||||||||||

| Norton | $ | 1,338,750 | $ | 425,000 | $ | 425,000 | $ | 488,750 | ||||||||

| Trueblood | $ | 510,000 | $ | 127,500 | $ | 127,500 | $ | 255,000 | ||||||||